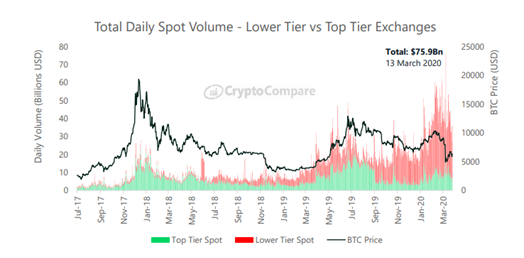

Last month's market crash that saw the price of bitcoin plummet from $7,100 to $3,800 in a two-day period led to the highest daily crypto trading volumes ever.

Binance has quietly removed Visa mentions from the official website of its upcoming Binance Card. Its official Twitter account also deleted a tweet referencing the payments giant.

A total of 11 class-action lawsuits have been filed against seven cryptocurrency exchanges alleging these sold unlicensed securities via initial coin offerings (ICOs) and initial exchange offerings (IEOs) without a broker-dealer license.

Top stories in the Crypto Roundup today:

- Crypto Market Crash Led to Highest Daily Volumes Ever

- Binance Removes Visa Mentions From its Payment Card Website

- 11 Class-Action Lawsuits Filed Against Seven Crypto Firms

At the time of writing, bitcoin (BTC) is trading at $7,066.09 (4.11%) with a daily Top Tier volume of $2.66 bn. As for ether (ETH), it is trading at $150.23 (4.98%) with a daily Top Tier volume of $544.54 million. The MVIS CryptoCompare Digital Assets 10 Index is currently tracking at 2,336.51 (3.77%).