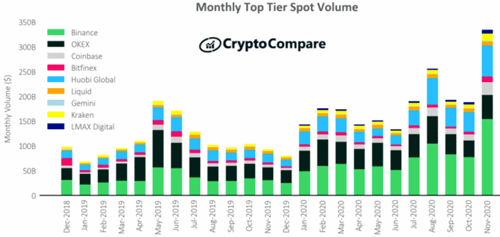

CryptoCompare’s November 2020 Exchange Review has found that the average monthly spot trading volume on Top-Tier cryptocurrency exchanges, based on the Exchange Benchmark, increased by 114% compared to October, with Binance managing to capture 44% of the total spot trading volume for the month.

The French Ministry of Finance has unveiled stringent know-your-customer (KYC) requirements for cryptocurrency transactions.

Bitwise Asset Management, a leading provider of index and beta funds for the crypto market, announced that shares of the “Bitwise 10 Crypto Index Fund” will start public quotation on OTCQX today under the ticker symbol “BITW”.

Top stories in the Crypto Roundup today:

- Spot Trading on Top Tier Crypto Exchanges Up 114% in November

- France Imposes Stringent KYC Requirements for Crypto Transactions

- U.S. Investors Can Now Trade Bitwise’s Crypto Index Fund Via Brokerage Accounts

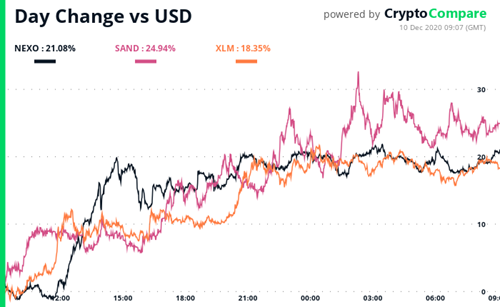

- NEXO, SAND, XLM Are Moving in the Crypto Market