The price of bitcoin has entered uncharted territory above the $23,000 mark after moving up from little over $19,300 in a single day. Analysts appear to believe the cryptocurrency still has room to grow in its current rally.

One River Asset Management, a hedge fund specializing in volatility bets, has reportedly become one of the largest investors in Bitcoin after buying over $600 million worth of crypto, and plans to build its position to $1 billion in BTC and ETH by early 2021.

U.K.-based Ruffer Investments has confirmed it made a $744 million bitcoin bet in an email, in which it detailed its position of BTC is equivalent to 2.7% of its assets under management.

Top stories in the Crypto Roundup today:

- Bitcoin’s Price Enters Uncharted Territory Above $23,000

- One River Commits to Holding $1 Billion in BTC and ETH by Early 2021

- Ruffer Investment Confirms $744 Million Bitcoin Bet

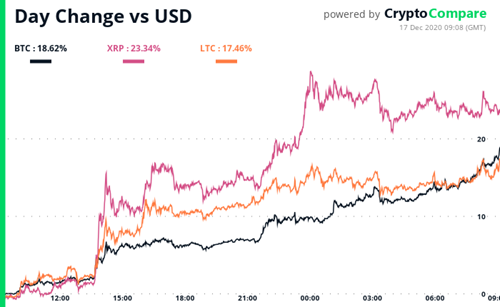

- BTC, LTC; XRP Are Moving in the Crypto Market