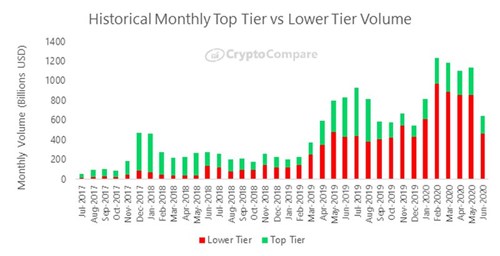

Crypto spot trading volumes plummeted last month, as top tier cryptoassets trading platforms saw their volumes drop 36% compared to May, while lower tier platforms lost 53% of their volume over the same period.

Voice, the EOSIO-based social media platform created by Block.one has launched. It’s currently in read-only mode to the public, while allowing registered community members to publish content.

Brazil’s securities watchdog, the Comissão de Valores Mobiliários (CVM), has barred Binance form offering cryptocurrency derivatives to users in the country.

Top stories in the Crypto Roundup today:

- Crypto Trading Volumes Plummeted in June

- Crypto-Powered Social Media Platform Voice Has Launched

- Brazil’s Securities Watchdog Halts Binance From Offering Derivatives to Users in the Country

At the time of writing, bitcoin (BTC) is trading at $9,267.14 (0.83%) with a daily Top Tier volume of $2.43 bn. As for ether (ETH), it is trading at $237.35 (1.70%) with a daily Top Tier volume of $1.03 bn. The MVIS CryptoCompare Digital Assets 10 Index is currently tracking at 3,129.67 (-1.40%).