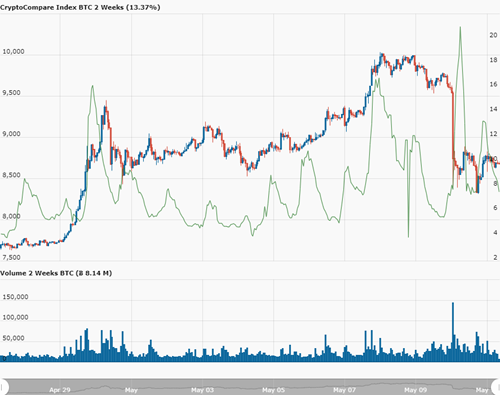

The price of bitcoin dropped a little over 12% this Saturday in a 15-minute period, causing well over $200 million worth of liquidations on derivatives trading platform BitMEX. During the Crash, Coinbase went offline.

Google has deleted 22 extensions from the Chrome web store impersonating popular cryptocurrency wallets in a bid to get users to give up their private keys or mnemonic phrases.

Croatia’s financial regulator, Hanfa, has approved the country’s first bitcoin investment fund, the Passive Digital Asset fund.

Top stories in the Crypto Roundup today:

- Bitcoin’s Price Tanks 12% in 15 minutes, causing $226 Million of Liquidations

- Google Deleted 22 Extensions Impersonating Crypto Wallets

- Croatia’s Financial Supervisor Approved Bitcoin Investment Fund

At the time of writing, bitcoin (BTC) is trading at $8,668.94 (-1.74%) with a daily Top Tier volume of $4.62 bn. As for ether (ETH), it is trading at $187.41 (-1.86%) with a daily Top Tier volume of $1.17 bn. The MVIS CryptoCompare Digital Assets 10 Index is currently tracking at 2,819.08 (-15.16%).