Crypto asset manager Grayscale Investments has seen its Ethereum Trust (ETHE) product surpass the $1 billion mark in assets under management (AUM).

Cryptocurrency lender Cred had filed for Chapter 11 bankruptcy protection in Delaware, estimating in the filing it has assets between $50 million and $100 million, and liabilities between $100 million and $500 million.

OKEx has hired an “external legal counsel” to help it resume withdrawals from its platform, which were halted on October 16 after one of its private key holders got “out of touch” with the platform while cooperating with authorities in an investigation.

Sponsored: One of the world’s leading licensed and regulated Bitcoin sportsbook, backed by one of the top global financial firms, continues to improve its wide range of sporting events and casino games to bet on.

Top stories in the Crypto Roundup today:

- Grayscale’s Ethereum Trust Surpasses $1 Billion in Assets Under Management

- Crypto Lender Cred Files for Bankruptcy After Experiencing ‘Irregularities’

- OKEx Hired ‘External Legal Counsel’ to Help Resume Halted Withdrawals

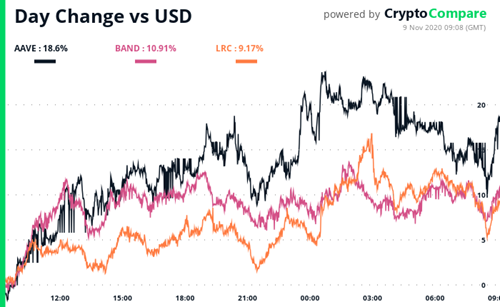

- AAVE, BAND, LRC Are Moving in the Crypto Market

- Sponsored: LatinBet24 continues to shatter the industry with its leading best odds and live betting action