CryptoCompare has caught up with representatives from some of the largest cryptocurrency exchanges in the space – including, OKCoin, Huobi, EXMO, and KuCoin – to get their thoughts on how the space is evolving, and what the future holds for cryptocurrency exchanges.

Cryptocurrency asset manager Grayscale Investments has released its financial report for the third quarter of the year, and revealed it raised $1.05 billion into its investment products, making it the “largest capital inflow in a single quarter in the firm’s history.”

San Francisco-based cryptocurrency exchange Coinbase reportedly holds approximately 994,904 BTC in cold storage, according to data from bitcoin analytics platform ChainInfo.

Top stories in the Crypto Roundup today:

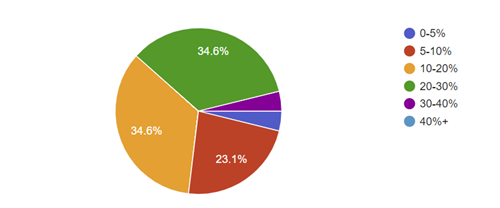

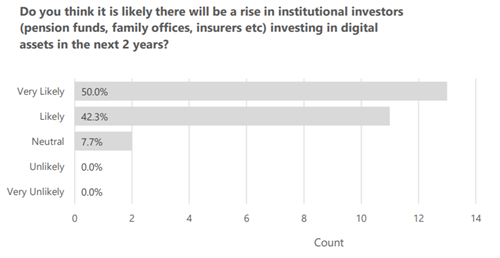

- Decentralized Exchanges Will Keep Growing, Even as Institutions Invest in Crypto

- Grayscale Posts Record Quarter With Inflows Above $1 Billion

- Coinbase Holds $11 Billion of Bitcoin in Its Wallets

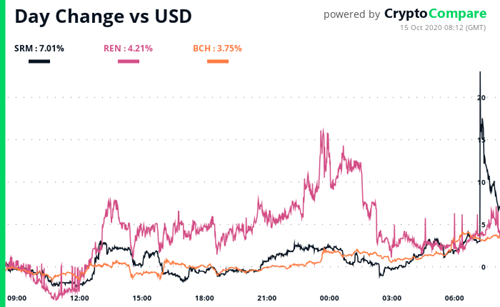

- SRM, REN, BCH Are Moving in the Crypto Market