MicroStrategy, the billion-dollar business intelligence firm that invested $425 million into bitcoin this year, has redirected the premium hope.com domain to a page focused on offering user educational resources on bitcoin.

San Francisco-based crypto exchange Coinbase has revealed it received 1,914 requests for customer data from law enforcement agencies throughout the world in the first half of this year. It isn’t clear how many of the requests were fulfilled.

Cryptocurrency payments platform Wirex has revealed it surpassed its crowdfunding target by over 370% after raising over £1 million ($1.2 million) in just 90 minutes.

Top stories in the Crypto Roundup today:

- MicroStrategy Redirects Hope.com to Bitcoin-Focused Page

- Coinbase Received 1,900 Law Enforcement Requests for Client Info

- Binance Burns $68 Million of BNB in Its Largest Quarterly Burn to Date

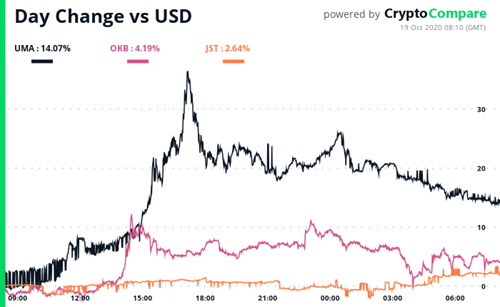

- UMA, OKB, JST Are Moving in the Crypto Market