Jack Dorsey’s Square has revealed its Cash App has seen bitcoin-related revenue rise 200% year over year to $2.72 billion, up from $875 million, while bitcoin gross profit jumped from $17 million to $55 million.

Moody’s has downgraded El Salvador’s rating and continued to have a negative view on the country’s economy partly because of the government’s law that will make Bitcoin legal tender there.

Wealthfront has started to integrate cryptocurrency-related offerings to its robo-advisory offerings, starting with a pair of Grayscale funds.

Sponsored: Buy bitcoin and 100+ cryptocurrencies with 20+ fiat currencies. New users can enjoy 0% credit/debit card fees on all crypto purchases made in their first 30 days. Join 10 million users and download the Crypto.com App now.

Top stories in the Crypto Roundup today:

- Square’s Cash App Bitcoin Revenue Rose 200% in Q2

- Moody’s Downgrades El Salvador’s Rating Partly Over Bitcoin Bill

- Wealthfront Adds Crypto-Related Funds to its Robo-Advisory Offerings

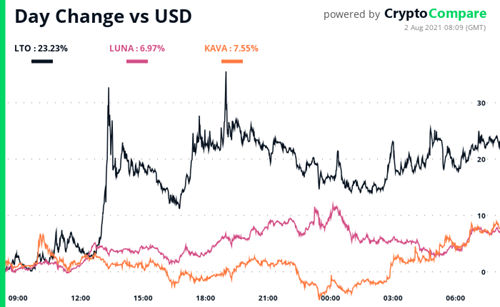

- Daily Movers – LTO, LUNA, KAVA

- Sponsored: Crypto.com - The World’s Fastest Growing Crypto App