U.S. Securities and Exchange Commission (SEC) Chairman Gary Gensler has revealed he believes the vast majority of cryptocurrencies and initial coin offerings (ICOs) violate U.S. securities laws.

Bitcoin SV has suffered a 51% attack after “some serious hashing power” was unleashed on the network and used to reorganize blocks on it. During the attack, the Bitcoin Association recommended node operators invalidate the fraudulent chain.

HSBC has become the latest British bank to bar payments to popular cryptocurrency exchange Binance citing a consumer warning by the Financial Conduct Authority (FCA). The bank told its customers the decision came “due to concerns about the possible risks to you.”

Sponsored: Another exciting quarter has come and gone and despite the turmoil experienced in crypto markets after mid-May, the Invictus Capital suite of funds has continued to offer investors exceptional returns, with the Hyperion VC (IHF), Margin Lending (IML) and Crypto10 Hedged (C10) Funds all shooting the lights out.

Top stories in the Crypto Roundup today:

- SEC Chairman Believes ‘Every ICO is a Security’

- Bitcoin SV Suffers Yet Another 51% Attack

- HSBC Bars Payments to Crypto Exchange Binance

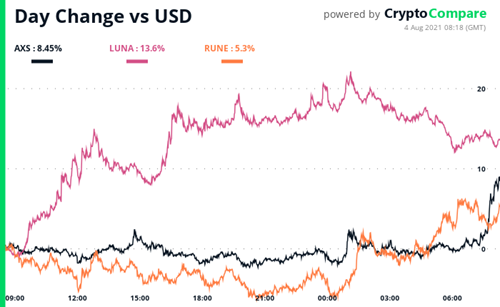

- Daily Movers – AXS, LUNA, RUNE

- Sponsored: Invictus Capital Q2 2021 Investment Report