The cryptocurrency community in the United States is rallying to change what are seen as “unworkable requirements” in the 2,700-page infrastructure bill caused by poorly-worded language that “could mean anything.”

Google has revised its ad policies to now allow cryptocurrency companies to advertise on the internet giant’s network once again. The new ad policy comes after it banned crypto companies and initial coin offerings (ICOs) from advertising on its platform in March.

JPMorgan has reportedly started pitching its wealthy clients an in-house bitcoin fund. The firm’s Private Bank clients are being offered a passively managed fund in partnership with NYDIG.

Sponsored: Another exciting quarter has come and gone and despite the turmoil experienced in crypto markets after mid-May, the Invictus Capital suite of funds has continued to offer investors exceptional returns, with the Hyperion VC (IHF), Margin Lending (IML) and Crypto10 Hedged (C10) Funds all shooting the lights out.

Top stories in the Crypto Roundup today:

- Crypto Community Rallies to Change ‘Unworkable Requirements’ in Infrastructure Bill

- Google Starts Allowing Some Cryptocurrency Ads

- JPMorgan Pitches In-House Bitcoin Fund to Wealthy Clients

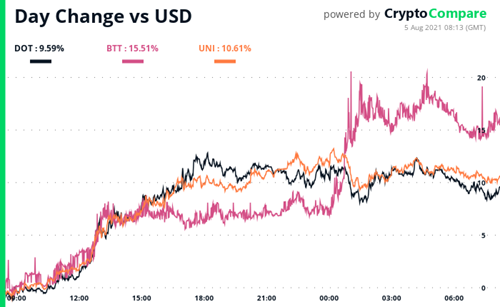

- Daily Movers – DOT, BTT, UNI

- Sponsored: Invictus Capital Q2 2021 Investment Report