The hacker or team of hackers who stole $600 million from cross-chain decentralized finance protocol Poly Network and then started returning funds, has delayed returning a final tranche worth over $235 million through a multisig wallet.

Fitch Ratings has warned El Salvador that its move to embrace bitcoin as legal tender poses a serious risk to the country’s insurance companies.

Over $170 million worth of the second-largest cryptocurrency by market capitalization, ether, have been burned since the Ethereum network’s London hard fork went live on August 5.

Sponsored: Global GT, the 1st regulated Hybrid Broker offers 8 assets classes, catering to the needs of both FX and Crypto traders, two of which include the exclusive GTi12 Index and Synthetic Cryptos.

Top stories in the Crypto Roundup today:

- Poly Network Hacker Prolongs Return of Funds

- Fitch Warns El Salvador Embracing Bitcoin Will Hurt Local Insurers’ Credit Ratings

- Over $170 Million in ETH Have Been Burned So Far

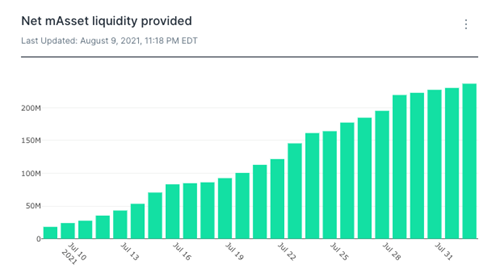

- Looking at mAsset Liquidity

- Sponsored: Synthetic Cryptos & GTi12 Index, two new trading trends offered by Global GT