Wells Fargo and JPMorgan have both registered a Bitcoin fund with the U.S. Securities and Exchange Commission (SEC). Both have partnered with the New York Digital Investment Group (NYDIG) on the offerings.

Nasdaq-listed cryptocurrency exchange Coinbase has received approval from its board to purchase over $500 million worth of cryptocurrency for its balance sheet.

BlackRock, the $9 trillion multinational investment manager, has invested over $380 million in two bitcoin mining firms, according to filings with the SEC.

Sponsored: The Aventus Network (AvN), a 2nd-layer blockchain protocol is set to close round two of its Validator Registration Program to Aventus Token (AVT) holders at full capacity. This follows the announcement of a new partnership with gaming social network, fruitlab.

Top stories in the Crypto Roundup today:

- Wells Fargo and JPMorgan Launch Bitcoin Funds

- Coinbase to Add $500 Million Worth of Crypto to its Balance Sheet

- BlackRock ETFs Invested in Bitcoin Mining Firms

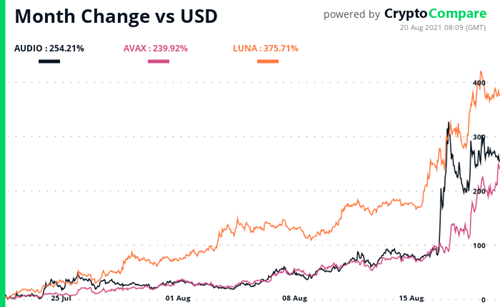

- Crypto Market Movers – AUDIO; AVAX, LUNA

- Sponsored: Aventus Staking Program Now More Than 80% Full As Aventus Partners with fruitlab