Morgan Stanley investment funds have acquired over 6.5 million shares in Grayscale Bitcoin Trust (GBTC) as large financial institutions eye ways to give their clients exposure to the nascent cryptocurrency sector.

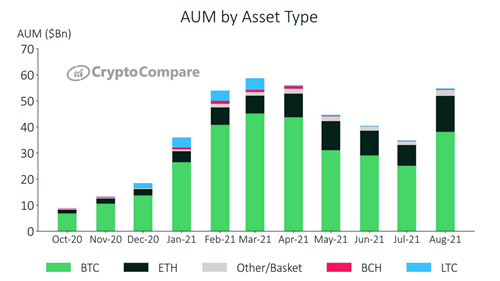

Since July, total assets under management (AUM) across all digital asset investment products has increased 57.3% to $54.8 billion as the market recovers. Bitcoin-focused products saw their AUM rise 51.9% to $38.1 billion, however, they lost market share and now represent 69.6% of the total.

Microsoft has been awarded a U.S. patent for software that can help users create applications on the blockchain by making it easier and more efficient to create tokens for different networks.

Top stories in the Crypto Roundup today:

- Morgan Stanley Buys 6.5 Million Grayscale Bitcoin Trust Shares

- Crypto Investment Products’ Total AUM Surges to $54.8 Billion

- Microsoft Awarded U.S. Patent on Crypto Token Creation Service

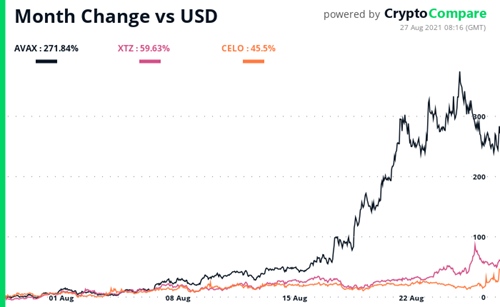

- Crypto Market Movers – AVAX, XTZ, CELO