Some tier-one Wall Street banks are reportedly figuring out how to use bitcoin as collateral for cash loans to institutions. These banks, which include Goldman Sachs, would not touch cryptocurrency spot markets and would instead lean towards synthetic crypto products.

South Korean lawmakers have delayed a proposed cryptocurrency tax plan which would levy a 20% tax on gains made in the cryptocurrency space in a one-year period over KRW 2.5 million ($2,122).

Brazil-based users of Latin American fintech firm Mercado Pago are now able to buy, sell, and hold cryptocurrencies directly on the same platform they use to make payments and send money.

Sponsored: Buy bitcoin and 100+ cryptocurrencies with 20+ fiat currencies. New users can enjoy 0% credit/debit card fees on all crypto purchases made in their first 30 days. Join 10 million users and download the Crypto.com App now.

Top stories in the Crypto Roundup today:

- Wall Street Banks Explore Bitcoin-Backed Loans

- South Korea Delays Crypto Tax Plans

- Mercado Pago’s Brazil-Based Users Can Now Buy, Sell, and Hold Crypto

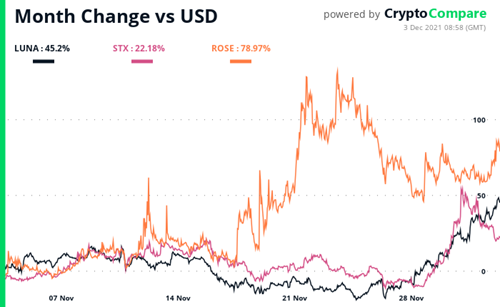

- Crypto Market Movers – LUNA, ROSE, STX

- Sponsored: Crypto.com - The World’s Fastest Growing Crypto App