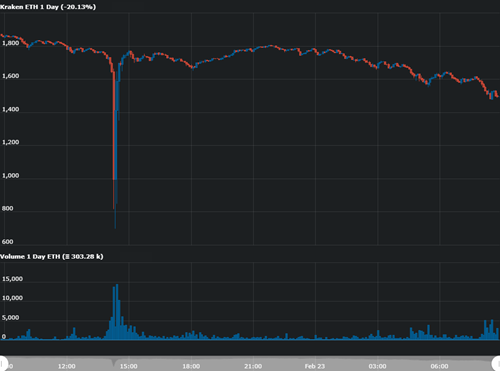

The price of the second-largest cryptocurrency by market capitalization, ether, dropped from around $1,800 to a $1,500 low on most cryptocurrency exchanges, but the massive sell-off saw it drop to $700 on Kraken in a flash crash.

Publicly-traded remittance firm MoneyGram has announced it suspended its use of Ripple’s payments platform in light of the company’s ongoing legal battle with the U.S. Securities and Exchange Commission (SEC).

Decentralized finance (DeFi) lending platforms have liquidated around $25 million worth of cryptoassets as the price of ETH dropped from $1,800 to $1,500. It’s the highest amount in three months after $93 million were liquidated on November 25, 2020.

Sponsored: Crypto.com Exchange has listed Filecoin on The Syndicate, where all Crypto.com Coin (CRO) stakers will be able to participate in a discounted sale event for 250,000 USD worth of FIL at 50% off. The event commenced on Tuesday, 23 February 6:00am UTC on the Crypto.com Exchange.

Top stories in the Crypto Roundup today:

- Ether Flash Crash on Kraken Sees ETH Trade at $700

- MoneyGram Suspends Use of Ripple’s Platform Over SEC Lawsuit

- $25 Million in DeFi Loans Liquidated Amid Crypto Market Decline

- Sponsored: Crypto.com Exchange is listing FIL at 50% OFF