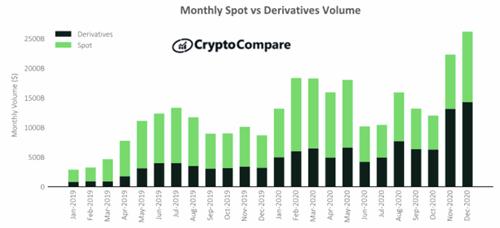

Derivatives trading volumes in the cryptocurrency space hit a new all-time high of $1.43 trillion in December, after rising 8.6% when compared to the previous month. In December, it’s worth noting, the price of BTC surged to $29,000.

Bitcoin’s mining difficulty has hit a new all-time high, surging 10.79% on Saturday to 20.65 trillion. This is the first time the mining difficulty, which measures the competitiveness of miners looking to find blocks and secure the network, has surpassed 20 trillion.

Morgan Stanley has bought 792,627 shares of business intelligence firm MicroStrategy, a company that over the past year invested over $1.1 billion in bitcoin and now holds 70,470 BTC in its wallets.

Top stories in the Crypto Roundup today:

- Crypto Derivatives Volumes Hit New $1.43 Trillion All-Time High in December

- Bitcoin Mining Difficulty Hits New All-Time High Above 20 Trillion

- Morgan Stanley Increases BTC Exposure By Buying 10% Stake in MicroStrategy

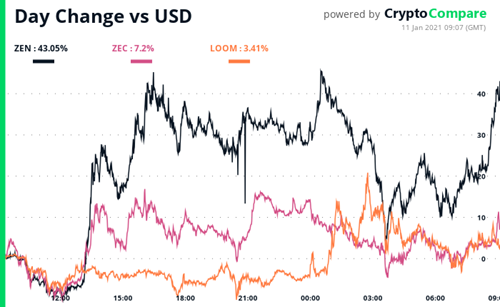

- ZEN, ZEC, LOOM Are Moving in the Crypto Market