The number of bitcoins being held by whale entities, defined as clusters of addresses controlled by a single network participant holding between 1,000 and 10,000 BTC, has risen by over 80,000 to 4.216 million BTC.

One of the “Big Four” accounting firms EY, commonly known as Ernst & Young, has announced the company contributed a set of tools to privately manage transactions on the Ethereum network. The company’s protocol reportedly helps ETH transaction fees become more affordable as well.

A ransomware group known as REvil has brought the networks of at least 200 U.S. companies down and demanded at least $70 million in bitcoin for a solution.

Sponsored: Buy bitcoin and 100+ cryptocurrencies with 20+ fiat currencies. New users can enjoy 0% credit/debit card fees on all crypto purchases made in their first 30 days. Join 10 million users and download the Crypto.com App now.

Top stories in the Crypto Roundup today:

- Bitcoin Held by Whale Entities Hits Two-Month High

- EY Launches Protocol to Bolster Private Transactions on Ethereum

- Ransomware Group Demands $70 Million in Bitcoin From 200 U.S. Firms

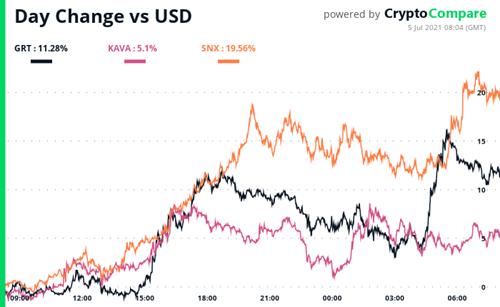

- Daily Movers - KAVA, GRT, SNX

- Sponsored: Crypto.com - The World’s Fastest Growing Crypto App