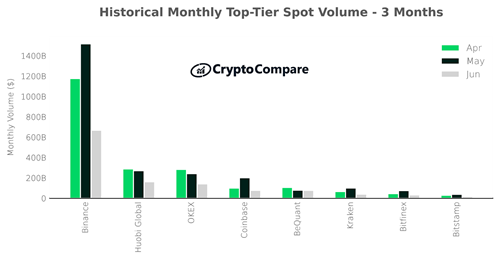

As cryptocurrency prices keep dropping and volatility remains relatively low, spot trading volumes in the cryptocurrency space decreased by an immense 42.7% in June, while total derivative volumes dropped 40.7%.

Stablecoin issuer Circle is planning on going public later this year through a merger with a special purpose acquisition company (SPAC) Concord Acquisition Corp. The deal is expected to close in the fourth quarter and would value the firm at $4.5 billion.

Digital payments firm Square is building a Bitcoin hardware wallet with the goal of making Bitcoin custody more mainstream. According to hardware lead Jesse Dorogusker it will focus on Bitcoin first and then “multisig to achieve ‘assisted-self-custody,’ and prioritizing mobile use.”

Sponsored: Sonar is a dynamic, all-in-one crypto tracking platform aiming to simplify and accelerate online investments. The cryptocurrency analytical ecosystem provides a safe place for users to research, manage, and decide on their current and future crypto investments by providing complete transparency and traceability.

Top stories in the Crypto Roundup today:

- Cryptocurrency Trading Volumes Plunge as Prices and Volatility Stall

- Stablecoin Issuer Circle to Go Public via $4.5 Billion SPAC Deal

- Square to Make ‘Assisted Custody’ Bitcoin Hardware Wallet

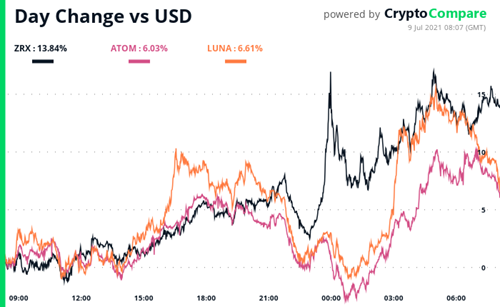

- Daily Movers – ZRx, LUNA, ATOM

- Sponsored: Sonar Introduces a Next-Gen Tracking Dashboard for the BSC and ETH Networks