The world’s largest online retailer may soon start accepting Bitcoin payments, according to an insider who chose to remain anonymous. The company has confirmed it’s exploring cryptocurrencies.

A poll conducted by American analytics firm Gallup has found that since 2018, Bitcoin and other cryptocurrencies have gained momentum among U.S. investors. It found that 6% of its 1,037 respondents own BTC, a 4% rise from 2018.

Leading decentralized exchange Uniswap has delisted a number of tokens from its application’s interface. The delistings were made by Uniswap Labs, the software developer that built the front-end of the exchange’s web portal.

Sponsored: Buy bitcoin and 100+ cryptocurrencies with 20+ fiat currencies. New users can enjoy 0% credit/debit card fees on all crypto purchases made in their first 30 days. Join 10 million users and download the Crypto.com App now.

Top stories in the Crypto Roundup today:

- Amazon is Looking to Accept Bitcoin Payments, Insider Says

- 6% of American Investors Own Bitcoin, New Poll Shows

- Uniswap Delists Tokens from Its Interface as Regulators Close In

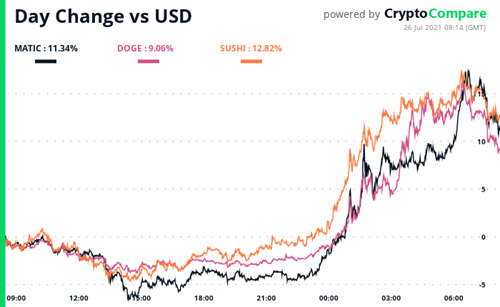

- Daily Movers – MATIC, DOGE, SUSHI

- Sponsored: Crypto.com - The World’s Fastest Growing Crypto App