Decentralized exchanges (DEXs) like Uniswap have helped the decentralized finance space grow to have over 3 million unique addresses interact with its applications. The top three protocols by address interaction are either DEXs or DEX aggregators.

The developers of the privacy-focused cryptocurrency Monero (XMR) have disclosed a “significant” bug that could impact the privacy of users’ transactions. The bug was initially investigated by software developer Justin Berman.

Leading cryptocurrency exchange Binance has announced a number of steps to improve its regulatory compliance after receiving warnings from multiple regulators.

Sponsored: Another exciting quarter has come and gone and despite the turmoil experienced in crypto markets after mid-May, the Invictus Capital suite of funds has continued to offer investors exceptional returns, with the Hyperion VC (IHF), Margin Lending (IML) and Crypto10 Hedged (C10) Funds all shooting the lights out.

Top stories in the Crypto Roundup today:

- Decentralized Exchanges Help DeFi Surpass 3 Million Users

- Monero Developers Disclose Privacy Algorithm Bug

- Binance Announces Steps to Improve Regulatory Compliance

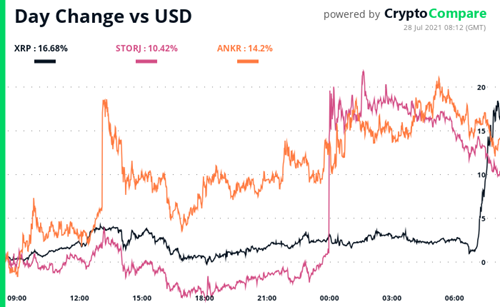

- Daily Movers – XRP, STORJ, ANKR

- Sponsored: Invictus Capital Q2 2021 Investment Report