Interest in Ethereum has been growing exponentially over the last few months, partly because of the growth of the decentralized finance (DeFi) space within the cryptocurrency’s blockchain. Its trading volume surged 1,461% in H1 2021, while Bitcoin’s moved up 489%.

Cryptocurrency custodian Anchorage Digital has been hired by the U.S. Marshals Service, one of the primary law enforcement agencies of the Department of Justice,to custody seized or forfeited cryptoassets.

The series of animated shorts sold in the form of non-fungible tokens (NFTs) developed by Mila Kunis’ Orchard Farm Productions, Stoner Cats, has sold out and led to the loss of 344.6 ETH ($790,000) in failed transactions.

Sponsored: Another exciting quarter has come and gone and despite the turmoil experienced in crypto markets after mid-May, the Invictus Capital suite of funds has continued to offer investors exceptional returns, with the Hyperion VC (IHF), Margin Lending (IML) and Crypto10 Hedged (C10) Funds all shooting the lights out.

Top stories in the Crypto Roundup today:

- Ethereum Trading Volume Grew Exponentially Year-to-Date

- Anchorage to Custody Cryptocurrencies Seized by U.S. Marshals

- Mila Kunis’ NFT Token Sale Cost Users $790,000 in Failed Transactions

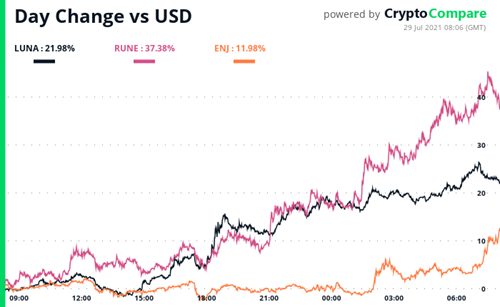

- Daily Movers – LUNA, RUNE, ENJ

- Sponsored: Invictus Capital Q2 2021 Investment Report