PayPal President and CEO Dan Schulman has revealed in the company’s Q2 earnings call that the firm is looking to expand its crypto buy and sell functionality to the United Kingdom as soon as next month.

Maryland-based firm ProShares has launched what it says is the first publicly available mutual fund tracking the price of the flagship cryptocurrency bitcoin. The Bitcoin Strategy ProFund invests in bitcoin futures.

Bitcoin’s hashrate has reached 115.27 EH/s this week, an 85% increase since the steep drop it suffered last month, after China’s crackdown on cryptocurrency mining saw its hashrate plunge to 58.84 EH/s.

Sponsored: Another exciting quarter has come and gone and despite the turmoil experienced in crypto markets after mid-May, the Invictus Capital suite of funds has continued to offer investors exceptional returns, with the Hyperion VC (IHF), Margin Lending (IML) and Crypto10 Hedged (C10) Funds all shooting the lights out.

Top stories in the Crypto Roundup today:

- PayPal to Roll out Crypto Trading in the UK

- New Bitcoin Mutual Fund Makes it Easier to Gain Exposure to BTC

- Bitcoin’s Hashrate Recovers from China’s Mining Exodus

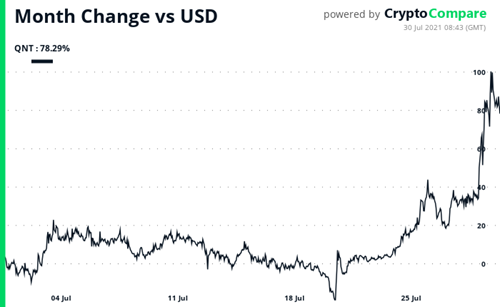

- Coin of the Week: Quant (QNT)

- Sponsored: Invictus Capital Q2 2021 Investment Report