El Salvador is looking to introduce a bill that will make it the first sovereign nation in the world to adopt bitcoin as legal tender, alongside the U.S. dollar.

U.K.-based Ruffer Investment Management has exited its bitcoin position after making $1.1 billion in profit in just five months. A Ruffer Investment director said the firm sold the last of its BTC because younger people are unlikely to spend so much time trading now that lockdowns are ending.

Cryptocurrency exchange FTX has made a deal with leading Esports organization TSM for it to change its name to TSM FTX. The deal will see FTX pay the team $21 million a year for 10 years.

Sponsored: ADD.xyz is a DeFi platform plugging multiple products into a single application that focuses on user experience, design, and privacy. By aggregating multiple DeFi protocols into a single application, it allows users to save on transaction fees.

Top stories in the Crypto Roundup today:

- El Salvador Plans to Make Bitcoin Legal Tender

- Ruffer Exits Bitcoin Position With $1.1 Billion in Profit

- FTX Pays Pro Esports Team $210 Million to Change Its Name

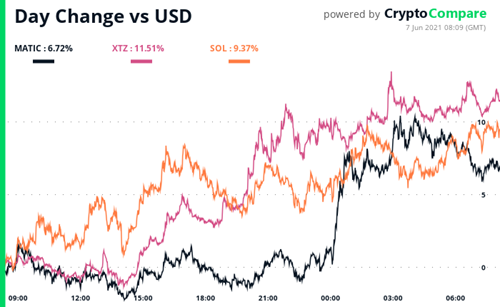

- Daily Movers – MATIC, SOL, XTZ

- Sponsored: ADD.xyz, The All In One Privacy-Focused DeFi Aggregator