The total open interest in the bitcoin futures market is down 59% from its $27.3 billion peak on April 13, and is now sitting at $11.3 billion, according to Arcane Research.

The cryptocurrency arm of the Intercontinental Exchange (ICE), Bakkt, has announced the launch of a new cryptocurrency Visa debit card dubbed “Bakkt Card.” It allows users to spend BTC and cash balances to purchase goods and services in stores where Apple Pay and Google Pay are accepted.

Norway’s Financial Supervisory Authority (FSA) has said there is a need for a legal framework if cryptocurrencies are to become a suitable form of investment for consumers.

Sponsored: Buy bitcoin and 100+ cryptocurrencies with 20+ fiat currencies. New users can enjoy 0% credit/debit card fees on all crypto purchases made in their first 30 days. Join 10 million users and download the Crypto.com App now.

Top stories in the Crypto Roundup today:

- Bitcoin Futures Open Interest Dropped 59% From Its Peak

- Institutional Exchange Bakkt Launches Crypto Debit Card

- Norwegian Financial Regulator Calls for Legal Framework for Crypto

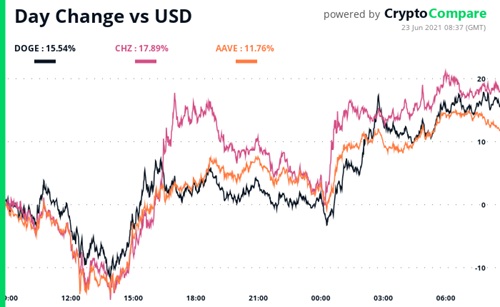

- Daily Movers – DOGE, CHZ, AAVE

- Sponsored: Crypto.com - The World’s Fastest Growing Crypto App