Nasdaq-listed cryptocurrency exchange Coinbase has revealed it’s expanding its prime brokerage services offering to institutional clients with a unit that ties custody, data, data analytics, and other amenities together.

MicroStrategy CEO Michael Saylor has defended the recently formed Bitcoin Mining Council, saying it was born to help shape the narrative around the flagship cryptocurrency’s energy use.

Crypto fund manager One River filed a bitcoin exchange-traded fund (ETF) registration with the U.S. Securities and Exchange Commission (SEC). It proposed the listing of a carbon-neutral bitcoin ETF on the New York Stock Exchange.

Sponsored: Invictus Capital, the alternative investment firm offering a range of dollar-denominated backed blockchain-based investment funds, has so far offered investors unparalleled returns. In the last year the top-performing funds, Crypto20 and Crypto10 Hedged, have achieved an increase of 979% and 441% respectively, and the Invictus Margin Lending (IML) fund boasted an industry-leading performance of 20% APY.

Top stories in the Crypto Roundup today:

- Coinbase Expands Prime Brokerage Services to Institutional Clients

- Bitcoin Mining Council to ‘Defend’ BTC Against ‘Uninformed’ Energy Critics

- Crypto Fund Manager One River Files Prospectus for Carbon Neutral Bitcoin ETF

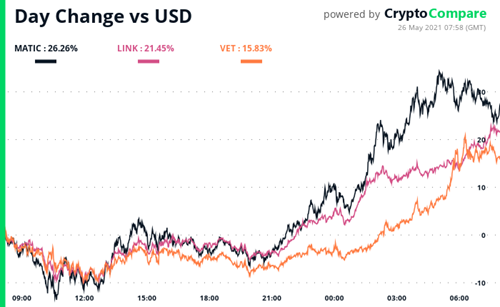

- Daily Movers – MATIC, LINK, VET

- Sponsored: Learn More About Invictus Capital's $10,000 Giveaway