PayPal is planning on allowing users to withdraw cryptocurrency bought on its platform to third-party wallets. The company started letting users buy, sell, and hold crypto back in October, but it currently doesn’t let them move their holdings off its platform.

Billionaire investor Carl Icahn has revealed he is interested in investing in the cryptocurrency space in a “big way” and could buy over $1 billion worth of crypto.

Apple is, according to a new job posting, looking to hire a business development manager with experience in the cryptocurrency industry to lead its “alternative payments” partnership program.

Sponsored: Invictus Capital, the alternative investment firm offering a range of dollar-denominated backed blockchain-based investment funds, has so far offered investors unparalleled returns. In the last year the top-performing funds, Crypto20 and Crypto10 Hedged, have achieved an increase of 979% and 441% respectively, and the Invictus Margin Lending (IML) fund boasted an industry-leading performance of 20% APY.

Top stories in the Crypto Roundup today:

- PayPal To Let Users Withdraw Crypto From Its Platform

- Billionaire Investor Carl Icahn Hints He May Invest in Crypto in a ‘Big Way’

- Apple Job Offer Cites Cryptocurrency Experience

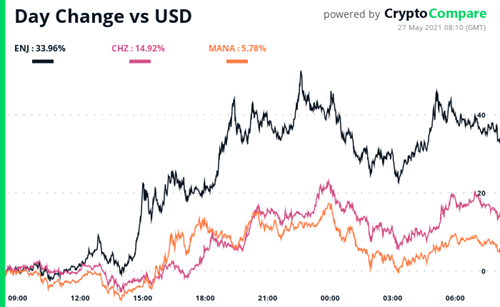

- Daily Movers – ENJ, CHZ, MANA

- Sponsored: Learn More About Invictus Capital's $10,000 Giveaway