The U.S. Securities and Exchange Commission (SEC) has filed a lawsuit against five people being accused of promoting the now-defunct cryptocurrency Ponzi scheme BitConnect.

Switzerland-based investment product provider 21Shares is listing three cryptocurrency exchange-traded products (ETPs) on the Euronext Paris stock exchange on June 1. Two of the ETPs will give investors exposure to bitcoin and ether, while a third product is a “short bitcoin” ETP.

Belt finance, a decentralized finance platform providing automated market making on the Binance Smart Chain (BSC), was hacked over the weekend in a flash loan attack that resulted in a $50 million loss for the platform, and a $6.23 million profit for the attacker.

Sponsored: If you want a great start on the StormGain crypto adventure, then make sure to use the code “MINER” for a bonus of $5 on your account and if crypto innovations are your gem, then you will definitely like what StormGain prepared for you.

Top stories in the Crypto Roundup today:

- SEC Sues Alleged Promoters of $2 Billion BitConnect Ponzi Scheme

- Three Crypto ETPs Are Being Listed on the Euronext Paris Exchange

- DeFi Protocol Belt Finance Loses $50 Million in Flash Loan Attack

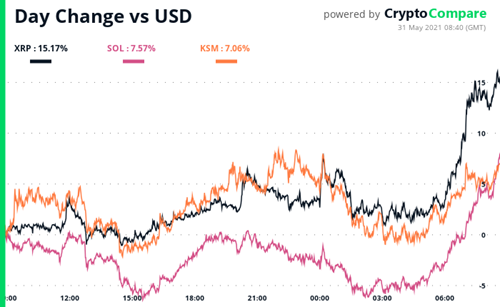

- Daily Movers – XRP, SOL, KSM

- Sponsored: Use this Bonus Code and Get $5 on Your StormGain Account