Popular cryptocurrency exchange Binance is letting its European users migrate their tokenized stocks to CM-Equity AG, the German investment firm that it has partnered with to list these stocks. Binance suddenly shut down its tokenized stock service in July after regulators closed in on it.

Decentralized finance (DeFi) money market Compound has an additional $65 million worth of COMP at risk due to a buggy upgrade to the protocol that went live last week.

Cryptocurrency asset manager Grayscale has added Solana (SOL) and Uniswap (UNI) to its large-cap cryptocurrency fund. The company, a subsidiary of the Digital Currency Group, manages $494 million in its Digital Large Cap Fund.

Sponsored: Fancy being a part of one of the world's largest decentralized autonomous organizations, BitDAO? Here's your chance. Bybit is giving away up to 600 BIT per user! As a token holder, you can make critical decisions relating to BitDAO to help shape the future of DeFi.

Top stories in the Crypto Roundup today:

- Binance Lets Users Move Tokenized Stocks Ahead of Service Shutdown

- $65 Million in COMP at Risk Waiting for Compound’s Time-Locked Bug Fix

- Grayscale Adds Solana to Digital Large Cap Fund

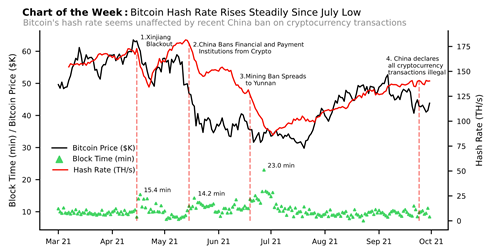

- Chart of the Week: Bitcoin Hashrate Steadily Rising

- Sponsored: Grab Up to 600 BIT on Bybit — And Be Part of BitDAO