Cryptocurrency companies raised a record $6.5 billion between July and September 2021 in a total of 339 funding rounds. The figure marks the third consecutive record this year, after firms raised $3.83 billion in the first quarter and $5.1 billion in the second.

The U.S. government may expand its efforts to study and regulate the cryptocurrency sector as the Biden administration is considering an executive order for federal agencies, which would require them to study the crypto industry and provide recommendations for its oversight.

MV Index Solutions GmbH in partnership with CryptoCompare today announced the launch of eight new digital asset indices covering decentralized finance (DeFi), infrastructure application, media and entertainment, and smart contracts.

Sponsored: Fancy being a part of one of the world's largest decentralized autonomous organizations, BitDAO? Here's your chance. Bybit is giving away up to 600 BIT per user! As a token holder, you can make critical decisions relating to BitDAO to help shape the future of DeFi.

Top stories in the Crypto Roundup today:

- Crypto Firms Raise Record $6.5 Billion in Q3 2021

- White House Considering Broader Crypto Market Oversight

- MVIS and CryptoCompare Launch 8 New Digital Asset Indices

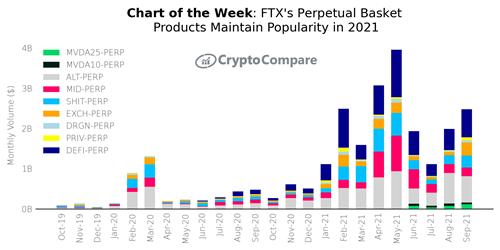

- Chart of the Week: FTX’s Perpetual Basket Products Popularity Maintained

- Sponsored: Grab Up to 600 BIT on Bybit — And Be Part of BitDAO