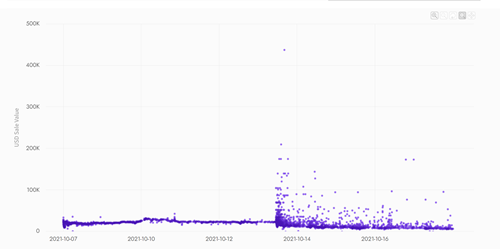

The first bitcoin futures exchange-traded fund (ETF), the ProShares Bitcoin Strategy Fund, has seen its assets under management swell to $570 million on its first day of trading. The fund had $20 million of seed capital at the start of the day.

Grayscale Investments and the New York Stock Exchange have filed to convert the world’s largest bitcoin fund by assets under management into an ETF -just as the first bitcoin futures ETF is launched.

Facebook’s cryptocurrency wallet Novi has launched in select markets in partnership with Coinbase. Five U.S. Senators have called for the immediate closure of the wallet in a letter sent to Facebook CEO Mark Zuckerberg.

This week we are going to examine the launch of one of the most widely anticipated NFT projects of the year - Mekaverse - brought to you in partnership with NFT data and discovery platform Masterpiece.

Sponsored: DJ Esports is a leading esports betting and crypto analysis platform. The platform supports all major e-sports games, including League of Legends, Dota 2, CS:GO, NBA 2K, and many others, and has over 3,000 active Discord members in their community.

Top stories in the Crypto Roundup today:

- ProShares Bitcoin Futures ETF Reaches $570 Million in Assets in First Trading Day

- Grayscale Files to Convert Bitcoin Fund Into an ETF

- U.S. Senators Pressure Facebook to Drop Novi Wallet Pilot

- NFT Spotlight: MekaVerse’s 8,888 Generative Mekas

- Sponsored: DJ Esports - Where Esports Meets the Blockchain