Banks in Spain are reportedly getting ready to offer cryptocurrency services to their clients, but the country’s central bank, the Bank of Spain, hasn’t provided them regulatory clarity. The Bank of Spain said it would provide instruction in June, however, the banks are still waiting.

Less than a week after becoming the second-most heavily traded fund on record in its debut, the ProShares Bitcoin Strategy ETF (BITO), is looking to change the way the ETF is run, as it filed for an exemption from trading limits at the Chicago Mercantile Exchange (CME).

New York-based decentralized prediction market Polymarket is reportedly being investigated by the U.S. Commodity Futures Trading Commission (CFTC). Specifically, the CFTC is investigating whether Polymarket is allowing its customers to trade binary options and swaps.

Sponsored: You’ve probably heard all about Curve Finance, the popular decentralized exchange for stablecoins, but may be put off by having to manage another on-chain wallet. Bybit has simplified the process for users like you, so you can get easy access to DeFi on Bybit.

Top stories in the Crypto Roundup today:

- Spanish Banks Are Reportedly Getting Ready to Offer Crypto Services

- ProShares’ Bitcoin Futures ETF Files for Trading Limits Exemption

- Decentralized Prediction Market Polymarket Targeted by CFTC Probe

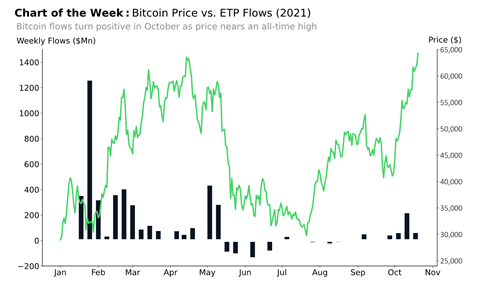

- Chart of the Week: Bitcoin Price vs. ETP Flows

- Sponsored: Check Out The Newest Liquidity Mining Pool on Curve Finance