The U.S. Federal Reserve, along with other government entities and officials, is struggling to deal with the financial disruption brought on by cryptocurrency’s move into banking and other financial services, according to an article in the New York Times.

The daily issuance of the world's second-largest cryptocurrency has gone negative for the first time since the Ethereum network's EIP-1559 upgrade.

Cover’s collapse follows an infinite minting hack in December 2020 that left its customers markedly uncovered by its insurance policies, and investors in the COVER token high and dry.

Sponsored: Buy bitcoin and 100+ cryptocurrencies with 20+ fiat currencies. New users can enjoy 0% credit/debit card fees on all crypto purchases made in their first 30 days. Join 10 million users and download the Crypto.com App now.

Top stories in the Crypto Roundup today:

- As More Consumers Bank With Crypto, Washington Sounds the Alarm

- Ethereum Records Negative Daily Issuance for the First Time Since EIP-1559

- DeFi Insurance Protocol Cover Shuts Down, Token Value Plummets

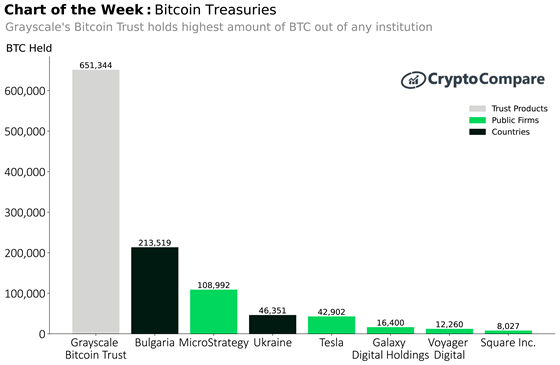

- Chart of the Week: Bitcoin Treasuries

- Sponsored: Crypto.com - The World’s Fastest Growing Crypto App