Ernest & Young (EY) announced via a press release yesterday that it would be utilising Polygon’s protocol and framework to deploy its own EY blockchain solutions onto Ethereum. EY said that they are looking to adopt Polygon’s scaling solutions to boost transaction volumes, providing “predictable costs” and settlement for enterprise customers.

Solana and SOL-tracking products continue to attract the interest of Institutional traders, with SOL products accounting for 86.6% of institutional inflows to digital asset investment products last week.

Interactive Brokers, a leading online brokerage firm, is teaming up with regulated blockchain infrastructure platform Paxos to enable the trading and custody of Bitcoin, Ethereum, Litecoin and Bitcoin Cash.

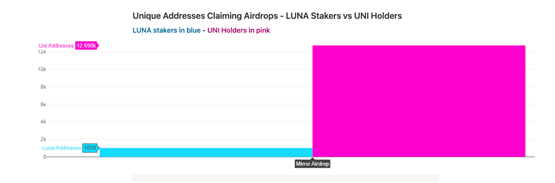

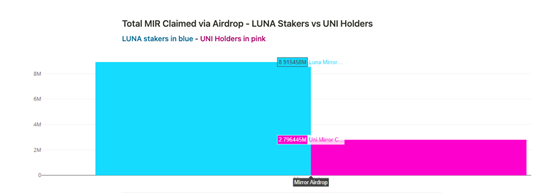

Airdrops have become a mainstream and widely used fixture in crypto, often used to attract and add new users to an ecosystem, or reward them for interacting with a protocol. But what are the real-world results of these airdrops?

Top stories in the Crypto Roundup today:

- Big Four Consulting Firm EY to Work With Polygon

- SOL-Tracking Products Continue To Attract Institutional Investors

- Interactive Brokers Partner With Paxos

- Flipside Crypto: How Many Addresses Are Receiving Airdrops?