Goldman Sachs is getting close to offering its first investment vehicles for Bitcoin and other cryptoassets to clients of its private wealth management group. Goldman is ultimately looking to offer a “full spectrum” of crypto investments.

Ethereum-based decentralized finance lending protocol Inverse Finance (INV) lost $15.6 million inan exploit that saw an attacker target its Anchor (ANC) money market to artificially manipulate token prices to borrow against extremely low collateral.

The CME Group is weighing introducing futures contracts for cryptocurrencies with smaller market capitalizations including Solana’s SOL and Cardano’s ADA. The move comes after it launched futures contracts tied to BTC and ETH.

Top stories in the Crypto Roundup today:

- Goldman Sachs to Offer Bitcoin to Wealth Management Clients

- DeFi Lender Inverse Loses $15.6 Million to Exploit

- CME Group Weighs Solana, Cardano Futures

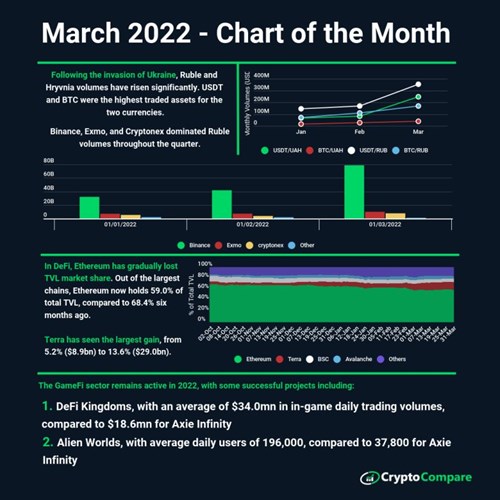

- March 2022 Chart of the Month