The Federal Bureau of Investigation (FBI), the Cybersecurity and Infrastructure Security Agency (CISA) and the U.S. Treasury Department have warned of the threat posed by cryptocurrency thefts and tactics used by the North Korean state-sponsored Lazarus Group.

Cryptocurrency startup Blockchain.com is reportedly interviewing banks for an initial public offering (IPO) that could come as soon as this year. Blockchain.com recently reached a $14 billion valuation in a Series D round.

A recently launched Ethereum-based project called Moonbirds has taken the top spot when it comes to non-fungible token (NFT) sales after generating more than $290 million in volume in just four days.

Sponsored: The Invictus suite of funds offered commendable performance in a quarter marked by heightened volatility in the Bitcoin and broader cryptoasset market. All five of the Invictus funds registered positive returns for the quarter, with the vast majority outperforming their benchmarks.

Top stories in the Crypto Roundup today:

- North Korean Actors are Targeting Crypto Companies, U.S. Gov Warns

- Blockchain.com Plans IPO as Early as This Year

- Moonbirds Take NFT Top Spot After $290 Million Sales in Four Days

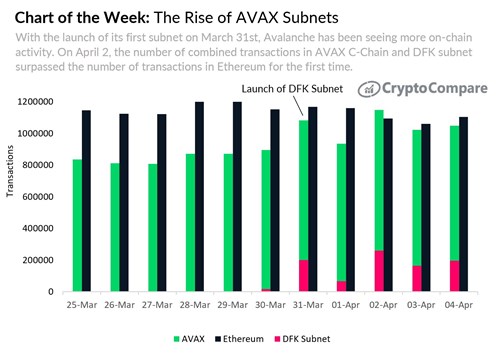

- Chart of the Week: The Rise of AVAX Subnets

- Sponsored: Invictus Capital continues to deliver an uninterrupted path of growth across all its funds