Nasdaq-listed cryptocurrency exchange Coinbase has launched its long-awaited non-fungible token (NFT) marketplace in beta form for select customers, after the exchange unveiled plans for it in October.

Switzerland-based firm 21Shares AG and leading exchange-traded fund (ETF) provider ETF Securities have launched two funds that offer investors access to the leading cryptoassets Bitcoin and Ethereum.

The development team behind pioneering cryptocurrency lending and stablecoin project MakerDAO has revealed plans to ingrate with Ethereum sidechain StarkNet, a zero-knowledge chain built by StarkWare.

Sponsored: The Invictus suite of funds offered commendable performance in a quarter marked by heightened volatility in the Bitcoin and broader cryptoasset market. All five of the Invictus funds registered positive returns for the quarter, with the vast majority outperforming their benchmarks.

Top stories in the Crypto Roundup today:

- Coinbase Launches NFT Marketplace in Beta

- 21Shares, ETF Securities Launch Bitcoin and Ethereum ETFs in Australia

- MakerDAO to Integrate with StarkNet as Part of Multi-Chain Strategy

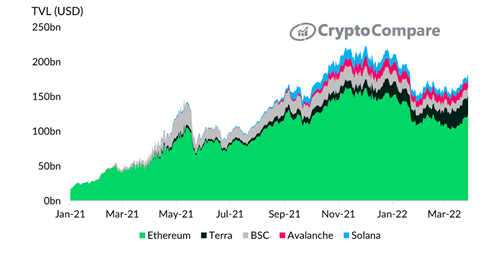

- 2022 Outlook: DeFi Growth Stalls as Macroeconomic Expectations Change

- Sponsored: Invictus Capital continues to deliver an uninterrupted path of growth across all its funds