Finance giant Schwab Asset Management has revealed it’s launching its first cryptocurrency-related exchange-traded fund (ETF) on the New York Stock Exchange Arca from August 4.

A majority of Aave’s decentralized autonomous organization (DAO) voters have approved creating a new stablecoin called GHO, which will be backed by collateral consisting of other cryptocurrencies.

Cryptocurrency hardware wallet maker Ledger is reputedly in talks to raise at least $100 million in a new funding round that will give it a higher valuation than what it commanded at its last financing round.

Top stories in the Crypto Roundup today:

- Schwab Asset Management Launches Crypto ETF

- Aave DAO Approves Creation of GHO Stablecoin

- Hardware Wallet Manufacturer Ledger Seeks New Funding

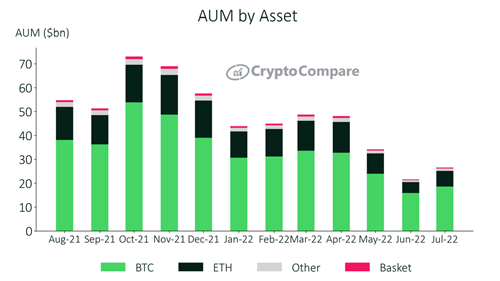

- Ethereum Investment Products AUM Rose 44.6% in July