Pension funds’ interest in the cryptocurrency market hasn’t disappeared despite the months-long bearish downturn the space has experienced, although they have reportedly considered whether to double down or walk away from their crypto exposure.

Polkadot-based decentralized finance (Defi) platform Acala has seen its native stablecoin aUSD, lose its peg over the weekend and plummet 99% after hackers exploited a bug in a newly-developed liquidity pool to mint 1.28 billion tokens.

Huobi Group’s founder, Leon Li, is reportedly in talks with investors to sell his majority stake in the cryptocurrency exchange at a valuation as high as $3 billion in what could be the industry’s largest deal since this year’s rout began.

Top stories in the Crypto Roundup today:

- Pension Funds Remain Interested in Crypto

- Polkadot-based Stablecoin Plunges 99% After Hackers Bloat Supply

- Huobi Chief in Talks to Sell $1 Billion Stake at Crypto Exchange

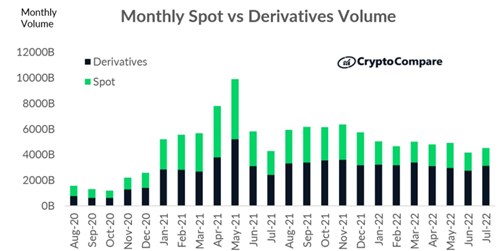

- Crypto Spot Trading Volumes Reach 20-Month Low