The former CEO of collapsed cryptocurrency exchange FTX, Sam Bankman-Fried, has said at a conference in New York that he “screwed up” but maintained that he “didn’t ever try to commit fraud,” and was shocked by the collapse of the exchange.

At the same conference Sam Bankman-Fried spoke, the CEO of the world’s largest asset manager BlackRock, Larry Fink, also commented on the FTX situation. Per Fink, BlackRock invested $24 million into the exchange.

Telegram CEO Pavel Durov has announced the company will begin building “non-custodial wallets” and “decentralized exchanges” to let millions of users safely trade their digital assets.

Top stories in the Crypto Roundup today:

- Ex-FTX CEO Says He ‘Didn’t Commit Fraud’

- BlackRock CEO Says Firm Invested $24 Million in FTX

- Telegram Announces Plan to Launch Decentralized Exchange

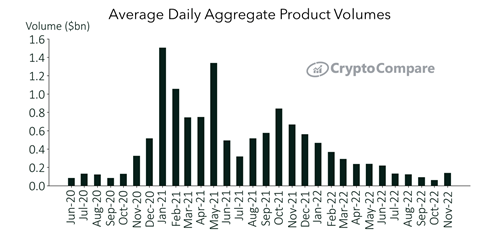

- Average Daily Aggregate Crypto Investment Product Volumes Rise