Stablecoin issuer Circle has dropped its plan to go public in a $9 billion deal through a blank-cheque company chaired by former Barclays CEO Bob Diamond, Concord Acquisition. The deal would have made Circle one of a handful of publicly traded crypto firms.

Cryptocurrency lender Nexo is planning to gradually cease operations in the United States, according to a post in which the firm says the decision to leave the country is “regrettable but necessary.”

Bitcoin’s mining difficulty has dropped by 7.2% to register its largest decline since July 2021, when China’s crackdown on mining forced miners to relocate and the network’s hashrate to plummet.

Top stories in the Crypto Roundup today:

- Circle Terminates $9 Billion SPAC Deal

- Crypto Lender Nexo to Leave US Over Lack of Clear Regulations

- Bitcoin Mining Difficulty Drops 7.2%

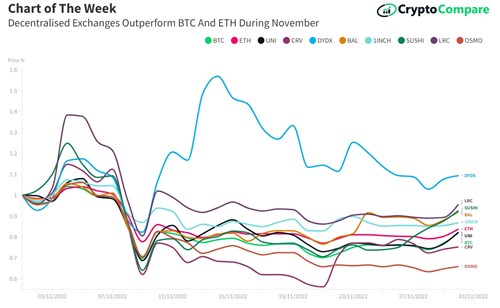

- Chart of the Week: Decentralised Exchanges Outperformed BTC and ETH