Wall Street giant Goldman Sachs is reportedly looking to spend tens of millions of dollars to buy or invest in distressed cryptocurrency companies in the wake of FTX’s collapse, which hit valuations and dampened investor interest.

Blockchain oracle network Chainlink has launched its staking feature to help increase the economic security of its oracle services. The new feature is an integral part of Chainlink’s Economic 2.0 effort.

Nigeria has drastically reduced the amount of cash that can be withdrawn at ATMs in a bid to push its “cashless Nigeria” policy and increase the use of the eNaira, the country’s Central Bank Digital Currency (CBDC).

Top stories in the Crypto Roundup today:

- Goldman Sachs Eyes Bargain Crypto Firms

- Chainlink Launches Staking to Increase Oracle Security

- Nigeria Limits Cash Withdrawals to Boost CBDC Usage

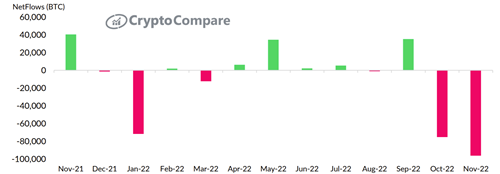

- Bitcoin Outflows From Exchanges Hit New High