The United Nations Refugee Agency (UNHCR) is launching a blockchain-based aid program to transfer USDC, a stablecoin created by Circle and Coinbase, to eligible recipients’ Vibrant digital wallets running on the Stellar network.

Nasdaq-listed cryptocurrency exchange Coinbase has launched a new tool to help customers recover more than 4,000 currently unsupported Ethereum-based tokens sent to its users’ addresses.

The first Bitcoin and Ether exchange-traded funds (ETFs) to be listed on the Hong Kong Stock Exchange have received nearly $54 million and $20 million in initial investments for a total near $75 million.

Top stories in the Crypto Roundup today:

- UN to Send USDC to Displaced Ukrainians

- Coinbase Launches ERC-20 Asset Recovery Tool

- Hong Kong Bitcoin and Ether ETFs Draw in $75 Million

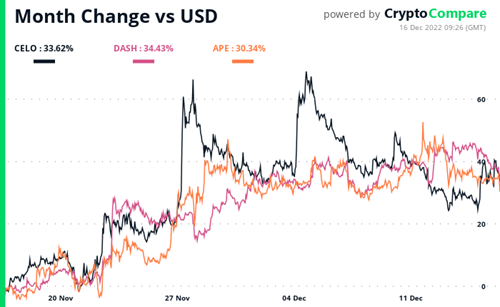

- Crypto Market Movers – CELO, DASH, APE