Japan’s Financial Services Agency is seeking feedback on new regulations that would allow foreign stablecoins to be listed on the country’s exchanges. The regulation would allow distributors to handle payments-focused stablecoins.

Cryptocurrency investment firm Midas Investments, which focused on decentralized finance (DeFi) yields, is shutting down following significant losses experienced in 2022.

Cryptocurrency exchange Kraken has decided to pull its operations in Japan for the second time, citing a strain on its resources during a “weak crypto market.” In a blog post, the firm detailed it will deregister from the Financial Services Agency by January 31, 2023.

Top stories in the Crypto Roundup today:

- Japan Considers Allowing Exchanges to List Foreign Stablecoins

- Midas Investments Shuts Down DeFi Platform Following Losses

- Kraken Exits Japan Over ‘Weak Crypto Market’

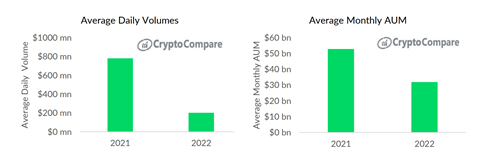

- Digital Asset AUM & Product Volumes Experience Significant Decline in 2022