The Bahamian Securities Commission has taken custody of more than $3.5 billion worth of FTX customer deposits, according to a media release. The regulator moved to take custody of the funds after media reports revealed FTX had been hacked.

The Central Bank of the Republic of Turkey has completed the “first payment transactions” of its central bank digital currency (CBDC), the Digital Turkish Lira, and has signaled plans to keep testing throughout 2023.

The U.S. Federal Bureau of Investigation (FBI) is investigating the data breach at trading bot platform 3Commas, after weeks of criticism from users of the Estonia-based service, who claim that its CEO repeatedly ignored warning signs that the platform leaked user data.

Top stories in the Crypto Roundup today:

- Bahamian Regulators in Custody of $3.5 Billion of FTX Deposits

- Turkish Central Bank Completes First CBDC Payment Transaction

- FBI Investigates 3Commas Data Breach

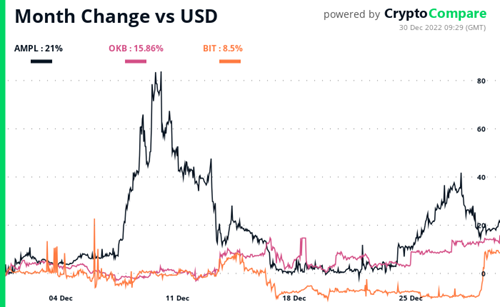

- Crypto Market Movers – AMPL, OKB, BIT