India’s finance minister Nirmala Sitharaman has said the country is planning on launching a digital version of the rupee as early as this year in an annual speech, she also outlined plans for a 30% tax on income from digital assets.

The Financial Times, in partnership with Wilshire and CryptoCompare, has launched an easy-to-use data platform for pricing and offering insights into the digital assets markets, utilising the FT Wilshire Digital Asset Index Series.

The hackers who stole bitcoin from cryptocurrency exchange Bitfinex in 2016 have moved a total of 64,643 BTC worth around $2.5 billion to unknown wallets in a series of transactions that included various amounts of BTC each.

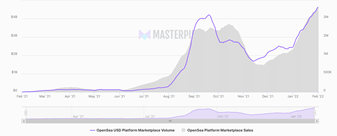

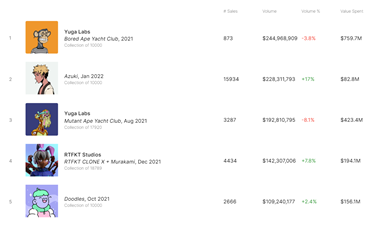

NFT was Collin’s Dictionary word of the year in 2021, and the market doesn’t seem to be slowing down anytime soon. In fact, 2022 has already seen a record month for NFTs, with monthly NFT trading volume reaching a record high of over $6 billion in January alone.

Sponsored: The Invictus suite of funds offered commendable performance in a quarter marked by heightened volatility in the Bitcoin and broader cryptoasset market. All five of the Invictus funds registered positive returns for the quarter, with the vast majority outperforming their benchmarks.

Top stories in the Crypto Roundup today:

- Financial Times Launches Cryptocurrency Pricing Dashboard with Wilshire & Data from CryptoCompare

- India to Launch Blockchain-Based Digital Rupee

- Bitfinex Hackers Move $2.5 Billion in Bitcoin from 2016 Hack

- NFT Spotlight: January In Review

- Sponsored: Invictus Capital continues to deliver an uninterrupted path of growth across all its funds