Bitcoin’s price has risen above its 50-day moving average for the first time in more than two months. The news comes after Bitcoin experienced its largest one-day rise since October, moving over the $40,000 mark.

A senior manager at the Bank of England has said it is “highly unlikely” the 327-year-old institution will develop a retail-facing wallet that could be used to store and spend digital currencies.

The U.S. Securities and Exchange Commission (SEC) has delayed its verdict on Grayscale’s proposed Bitcoin exchange-traded fund (ETF) proposal. The firm is looking to convert its Grayscale Bitcoin Trust (GBTC) into an ETF.

Sponsored: SX Network is the world`s first Polygon Layer-2 blockchain, built with the specific purpose of scaling DeFi, NFT, and betting applications. It is the only network that combines a smart contract platform with an on-chain community treasury and a native prediction market protocol.

Top stories in the Crypto Roundup today:

- Bitcoin Rises Above 50-Day Moving Average

- Bank of England ‘Highly Unlikely’ to Launch Retail Wallet for CBDC

- SEC Delays Decision on Grayscale’s Bitcoin ETF Conversion Proposal

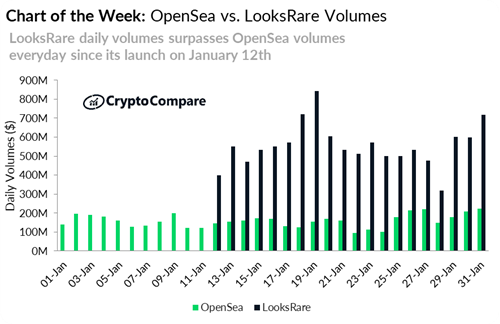

- Chart of the Week: OpenSa vs. LooksRare Volumes

- Sponsored: SX Network Introduces Polygon`s First Layer-2 Blockchain