El Salvador purchased 410 Bitcoin for $15 million, according to a tweet from the country’s president Nayib Bukele, who said “some guys are selling really cheap,” referring to BTC hitting a six-month low after an abrupt sell-off.

Rising competition amid decentralized exchanges has seen some trading platforms move to slash their trading fees. Uniswap, the leading decentralized exchange, launched with a 30 basis point fee for all trades. However, with the introduction of Uniswap v3 liquidity providers will be able to open pools with fees as low as 0.05%.

Comment letters released by the U.S. Securities and Exchange Commission (SEC) reveal Nasdaq-listed business intelligence firm MicroStrategy won’t be able to remove swings in the value of its bitcoin holdings from its unofficial accounting measures.

Sponsored: The Invictus suite of funds offered commendable performance in a quarter marked by heightened volatility in the Bitcoin and broader cryptoasset market. All five of the Invictus funds registered positive returns for the quarter, with the vast majority outperforming their benchmarks.

Top stories in the Crypto Roundup today:

- El Salvador Invests $15 Million in Bitcoin During Market Dip

- Decentralized Exchanges Slash Trading Fees

- SEC Rejects MicroStrategy’s Bitcoin Accounting Adjustment

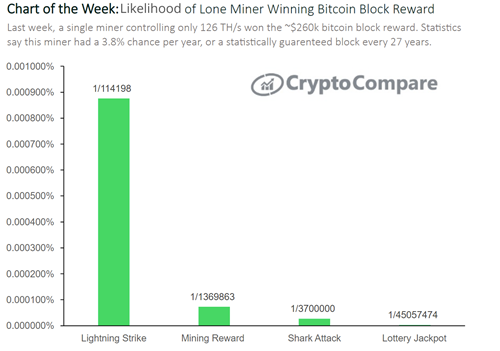

- Chart of the Week: Likelihood of Lone Miner Winning Bitcoin Block Reward

- Sponsored: Invictus Capital continues to deliver an uninterrupted path of growth across all its funds