Four major Indian cryptocurrency exchanges – ZebPay, WazirX, Giottus, and CoinDCX – have seen their daily trading volumes plunge between 60% and 87% after a 1% tax deductible at source became effective on July 1.

The Monetary Authority of Singapore, the country’s central bank, has been “carefully considering” more restrictive cryptocurrency regulations. According to Tharman Shanmugaratnam, senior minister and minister in charge of MAS, the regulator is mulling measures that will offer more protection to retail market participants.

Cryptocurrency lender CoinLoan says it has temporarily reduced the withdrawal limit for lenders amid the ongoing market turmoil. The European lender’s move sees it join a number of other crypto businesses freezing or limiting withdrawals.

Top stories in the Crypto Roundup today:

- Indian Crypto Exchange Volumes Plunge Over New Tax

- Singapore’s Central Bank Weighs More Crypto Safeguards

- Crypto Lender CoinLoan Lowers Withdrawal Limits

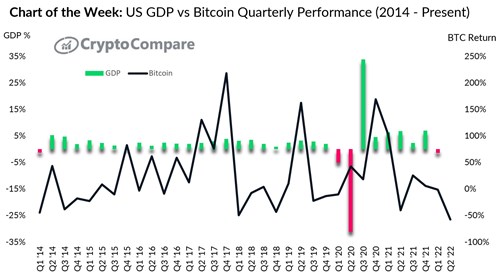

- Chart of the Week: US GDP vs. Bitcoin Quarterly Performance