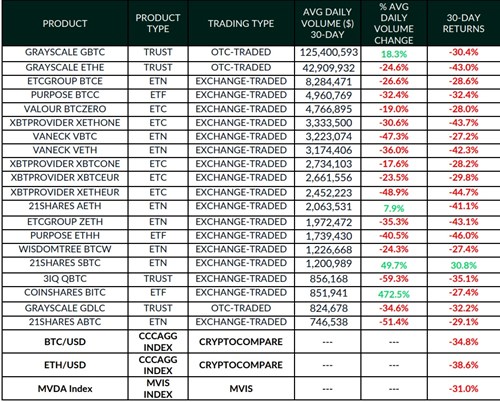

Last month several cryptocurrency exchange-traded products (ETPs) posted record losses, with the worst-performing product being 21Shares’ Aave ETP, which dropped 52.6%. ETPs focused on leading cryptocurrencies like BTC and ETH lost between 27% and 45% of their value.

Crypto lender Voyager Digital filed for Chapter 11 bankruptcy protection late Tuesday, becoming the second high-profile crypto firm to do so recently. The firm estimated it had more than 100,000 creditors and somewhere between $1 and $10 billion in assets.

Embattled crypto lender Celsius Network has been aggressively repaying debt on the largest decentralized finance protocol, Maker, possibly to recover bitcoin-equivalent tokens that had been posted as collateral for the loan.

Top stories in the Crypto Roundup today:

- Crypto ETPs Post Record Losses in June

- Voyager Digital Files for Bankruptcy Protection

- Celsius Network Repays $183 Million DeFi Loan

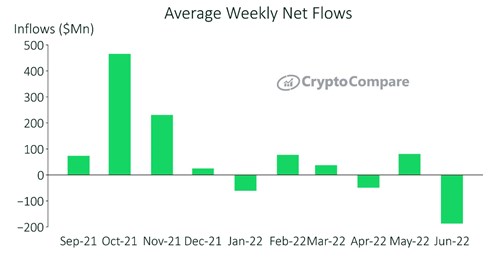

- Crypto Investment Products’ Weekly Net Outflows